Debt and Taxes

Sunday, February 19, 2012 at 7:48PM

Sunday, February 19, 2012 at 7:48PM

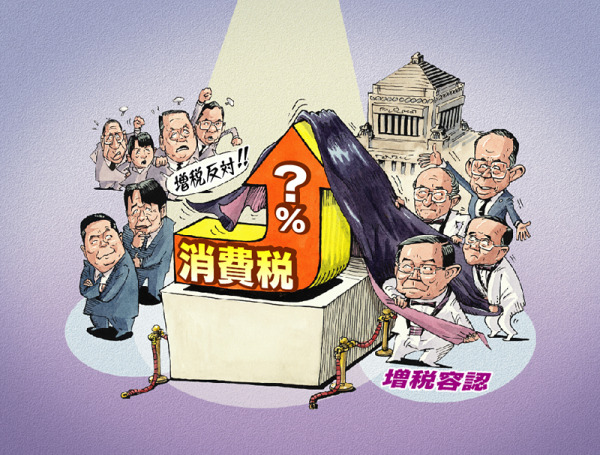

A somewhat dated political cartoon featuring the opposition Democratic Party of Japan (DPJ) in the upper left against an increase in the consumption tax proposed by the Liberal Democrats (LDP). The more things change, the more they stay the same. The Japanese government has recently unveiled plans for raising the consumption tax gradually over the next three years. From April 2014 the rate will be bumped up from the current 5% to 8%, and a year later to 10%. The IMF, meanwhile, has argued that the rate must be raised to at least 15% if Japan is to be serious about tackling the public debt which currently stands at more than double the size of its GDP. (By comparison, the ratio of Greece’s public debt to GDP is 143%; Italy’s, 119%.)

A somewhat dated political cartoon featuring the opposition Democratic Party of Japan (DPJ) in the upper left against an increase in the consumption tax proposed by the Liberal Democrats (LDP). The more things change, the more they stay the same. The Japanese government has recently unveiled plans for raising the consumption tax gradually over the next three years. From April 2014 the rate will be bumped up from the current 5% to 8%, and a year later to 10%. The IMF, meanwhile, has argued that the rate must be raised to at least 15% if Japan is to be serious about tackling the public debt which currently stands at more than double the size of its GDP. (By comparison, the ratio of Greece’s public debt to GDP is 143%; Italy’s, 119%.)

"When in a fix raise the tax on tobacco." Poor smokers have seen the price of cigarettes go up and up in recent years thanks to politicians too timid to take bold measures to reduce debt. The opposition LDP, which is vehemently against the tax hike is making renewed calls for a dissolution of the House of Representatives. These useless bastards, who can rightly be blamed for much of Japan’s present day woes, have been bolstered by a slide in the Noda cabinet’s approval rate, a dismal 32%, and polls suggesting that some sixty percent of people are opposed to an increase in the consumption tax.[1]

"When in a fix raise the tax on tobacco." Poor smokers have seen the price of cigarettes go up and up in recent years thanks to politicians too timid to take bold measures to reduce debt. The opposition LDP, which is vehemently against the tax hike is making renewed calls for a dissolution of the House of Representatives. These useless bastards, who can rightly be blamed for much of Japan’s present day woes, have been bolstered by a slide in the Noda cabinet’s approval rate, a dismal 32%, and polls suggesting that some sixty percent of people are opposed to an increase in the consumption tax.[1]

I’m not a big fan of the IMF, an organization which has caused undue suffering the world over, but I have to agree with it here. Besides, the consumption tax is quite low when compared to other countries. I do, however, have two concerns about the Noda plan: the uniformity of those planned tax hikes, and, two, the over-reliance on revenue increases alone to address Japan’s debt crisis.

When you consider how much the national and local government wastes on unnecessary public works—such as cementing the countryside over, spoiling Japan’s once beautiful coastline with “tetrapods” (gigantic concrete blocks resembling jacks), reclaiming land in a country with a falling population, and building gleaming new airports in places where nobody in their right mind would fly in or out of—it’s not difficult to see that there is quite a bit of room for cuts in spending. I say, for every one percent increase in the consumption tax, the government should try to find ways to reduce government spending by 10 percent. They could start with cutting the pay and number of politicians, reducing budgets in the nation’s behemoth bureaucracy, eliminating redundancies, and so on (See previous post). It’s high time for Japan’s public servants to start serving the public rather than the other way around.

Secondly, increases in the consumption tax should not be uniformly levied, as is the case today, but applied in a manner such that the tax is less regressive, less burdensome on those least able to pay. For example, maintain or reduce the 5% consumption tax on basic foodstuff, but raise it to 20% on, say, junk food and fast food. Keep it at 5% on domestically produced clothing, but 25% on clothing manufactured in China or Vietnam. Maintain the 5% consumption tax on hybrid and electric cars, but raise it to 15% on other vehicles, 25% or more on gas-guzzling SUVs and luxury cars. By manipulating the tax rates in this manner you can steer people towards habits that have long-term positive benefits on the environment, health, and society.[2]

On second thought, nix that idea. It’ll only encourage corporations to grease politicians’ palms in order to get their products exempted from the higher consumption tax. (More on this later.) Let’s just keep the tax on unprocessed foods, such as veggies, fruit, fish and meat at the current 5% and raise the tax on everything else. But, by all means, let’s bring the spending down first.

[1] According to Asia One News, “Nearly two-thirds of respondents to a recent nationwide Yomiuri Shimbun survey believe it is necessary to raise the consumption tax rate to maintain the nation's social security system. But only 16 per cent of the respondents said the tax increase should be in line with the government and ruling parties' plan to raise the tax to 8 per cent in April 2014 and then to 10 per cent in October 2015.”

[2] Some readers might comment that the government already has an “eco-point” scheme which provides rebates to consumers who opt for energy saving appliances and cars. I say, keep the program going.